The latest research by Lightspeed Commerce Inc., a comprehensive commerce platform empowering merchants to deliver optimal omnichannel experiences, reveals that British high streets could see a resurgence later this year. Nearly eight in ten Brits (79%) surveyed report that they shop in person, with four in ten indicating they plan to increase their visits to high street shops.

Consumer Sentiments on Rising Costs

Lightspeed’s study captures the nation’s sentiments regarding the rising costs of products over recent years. A substantial 77% of respondents believe that escalating prices for retailers—due to factors such as increased energy bills and rising rent—are the primary reasons behind higher prices. More than half (51%) of those surveyed feel that these price hikes are unfair, indicating a growing frustration among consumers.

Cost-Saving Strategies Among Shoppers

To mitigate these rising costs, shoppers are adopting various cost-saving measures. Some of the most common strategies include taking advantage of “2 for 1” deals (51%), switching to retailers that offer lower prices (39%), reducing shopping frequency compared to last year (38%), only shopping during sales periods (24%), and consulting family and friends about desired gifts to prevent unnecessary spending (24%).

Gen Z Spending Habits

Notably, Gen Z emerges as the most optimistic age group, with nearly a quarter (24%) indicating they are spending more now than they did 12 months ago. Additionally, 28% report making more impulsive purchases due to social media influences, while nearly a third (32%) of Gen Z shoppers now exclusively shop during sale periods to secure the best deals.

The Impact of Social Media on Purchases

The trend of #TikTokMadeMeBuyIt rings true, as it stands out as the platform exerting the most influence on social purchases among this demographic (59%). Following closely is Instagram (53%), and Facebook (24%). Despite Gen Z being the least likely to shop in-store, 33% have reported that they are influenced by social media to visit high street shops in search of items they’ve seen online.

The Growing Interest in Pre-Loved Items

While 62% of respondents claim they haven’t shopped for pre-loved or reconditioned items in-store, nearly half (46%) expressed plans to consider the ethical and sustainable origins of products before making new purchases. Those under 45 are the most inclined to buy reconditioned or pre-loved items, primarily motivated by cost-effectiveness (61%) rather than ethical concerns. Environmental considerations (35%) and perceptions that older items offer better quality than new ones (29%) also play a role.

Public Sentiment on AI in Retail

Regarding the use of AI in the shopping experience, opinions are divided. About 32% feel somewhat comfortable to very comfortable with AI integration, while 35% express discomfort. When questioned about their direct experiences, 41% of respondents indicated that the presence of self-checkout in more stores would enhance their shopping experience the most.

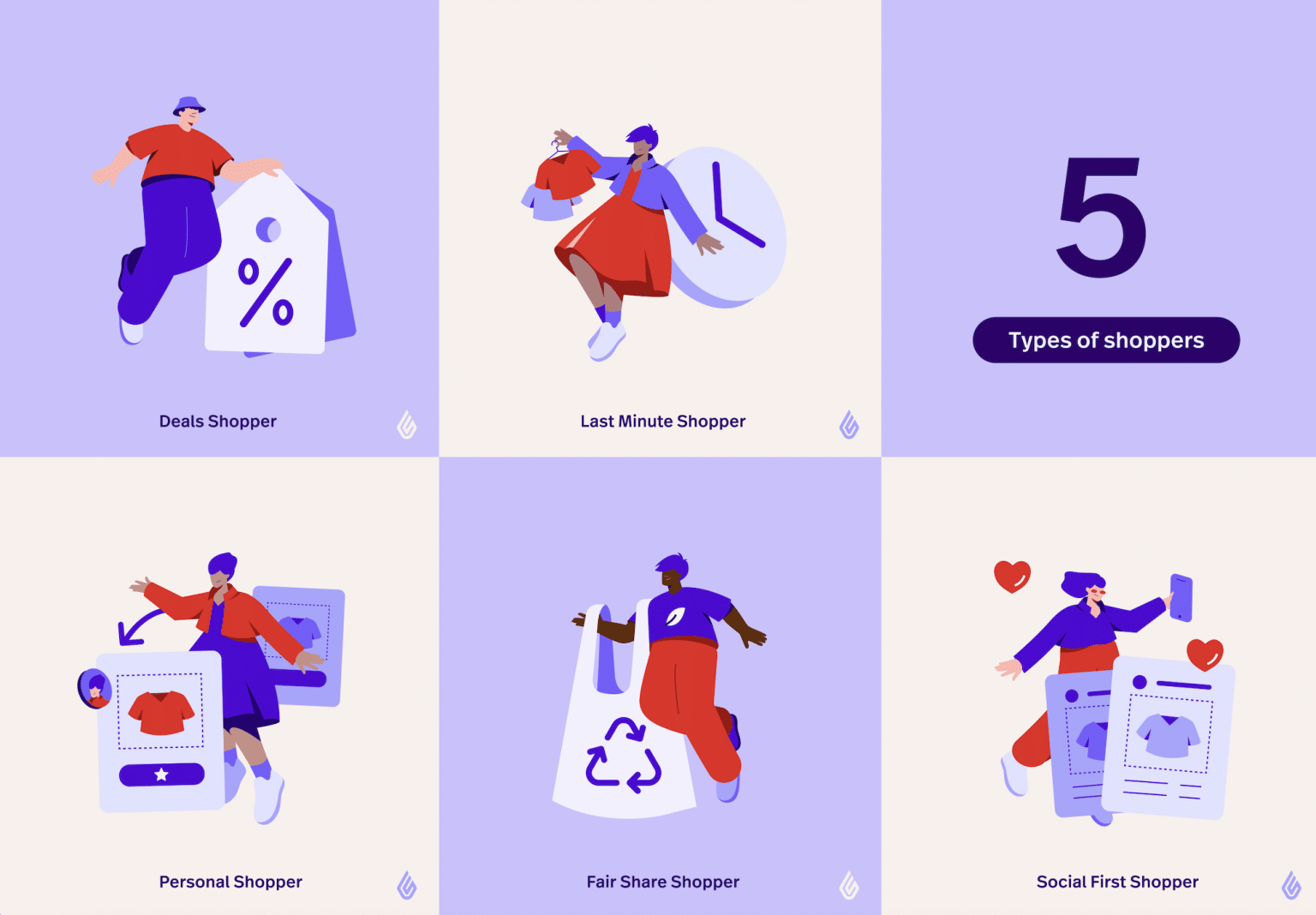

Emerging Shopper Typologies

When identifying their shopping style, a significant 70% labelled themselves as ‘Deals Shoppers,’ actively seeking discounts and offers. Meanwhile, 46% described themselves as ‘Last Minute Shoppers,’ preferring a speedy in-store experience. Other typologies include ‘Personal Shoppers’ (35%), ‘Fair Share Shoppers’ (32%), and ‘Social First Shoppers’ (17%).

Final Thoughts from Lightspeed

Liam Crooks, MD of EMEA at Lightspeed, states, “It’s encouraging for retail businesses to hear that people are looking to shop in-store in the second half of 2024. Retailers can thrive again in the UK by enhancing the shopping experience, utilizing AI technology, and providing personalized deals that resonate with customers.”